To learn more about cheques, view Module 03 (Cheques) of our educational video series.A lamp featuring a logo of Barclay's bank is seen outside a branch in London October 31, 2011. You will need to make other arrangements to pay the recipient. If you notice that a post-dated cheque is cashed early, you can ask that your financial institution return it, up to and including the day before the date on the cheque. However, given the large volume of cheques and automated processing, some items may slip through. Government of Canada cheques don't stale-date and your financial institution can confirm that they are still valid.Ĭheques should not be deposited before their due date. Financial institutions may still honour these items, but there is no obligation to do so.

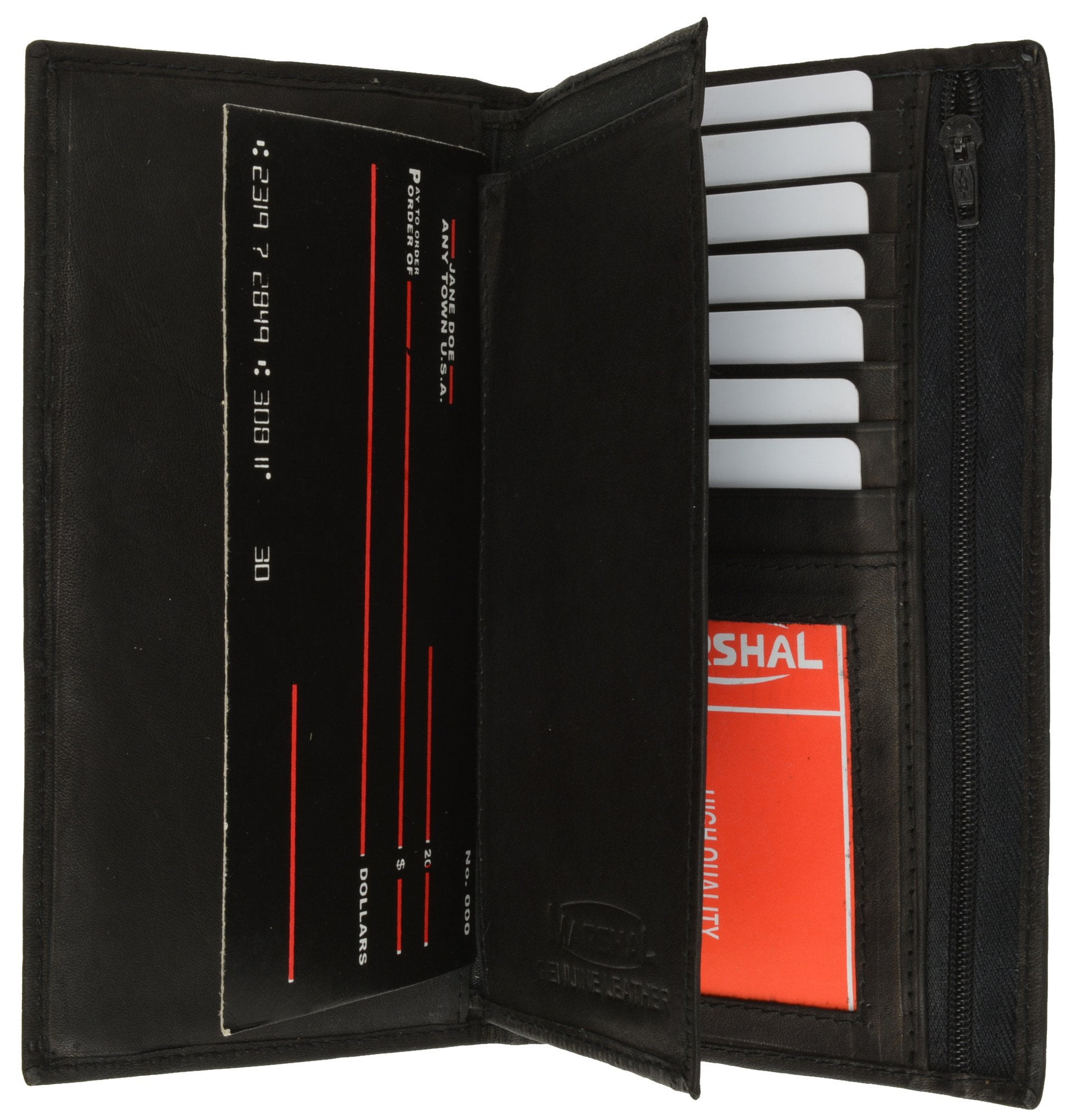

A stale-dated cheque simply means that the item is old, and not necessarily invalid. Depending on your bank's policies, you may able to access the money right away, or the funds might be put "on hold".įederally regulated financial institutions are required by law to limit the hold period on cheques. Our rules and standards do not address holds on cheques, but the Financial Consumer Agency of Canada's (FCAC) website has useful information on your rights and responsibilities.Ĭheques are considered stale-dated after six months, unless certified. When you deposit a cheque, your financial institution updates your account records to show a deposit of the amount indicated. If you're unsure whether an endorsement is required, check with your branch. Or, if a cheque is made out to Jane Doe, she can sign the back and give it to you. For example, if a cheque is made out to you and John Smith, you need John Smith's signature on the back of the cheque to deposit it in your account. If the cheque is made out to more than one person or if someone is giving you a cheque that was made out to them, make sure that it has all the required signatures on the back of the cheque (endorsements). When accepting a cheque, make sure the person paying you has filled all necessary fields correctly and has signed it. Make sure to keep your chequebook in a safe place, and never pre-fill or pre-sign cheques. Review your account activity regularly, and report any issues to your financial institution. It's a good idea to keep a record of the cheques you write so you know which ones have been deposited and which ones are still outstanding. You should ensure that you have sufficient funds in your account to cover the cheques that you write.

We recommend including the amount of the payment in words (even though it's not legally required), since it serves as a backup if the amount in figures is questioned.

If you're using a computer to do this, use a minimum 10 point font and dark ink colours that will show up well in images (black, blue or dark purple). If you're filling out a cheque by hand, use a ball-point or roller pen with black or blue ink. Payments Canada and its participant financial institutions have established rules and standards which set out the specifications for cheques (Standard 006), and cheque images (Rule A10), which can be deposited using your mobile phone. When you pay using a cheque, you are instructing your financial institution to give money from your account to the person (or organization) that is depositing the cheque. Cheque use is steadily declining as electronic alternatives gain in popularity, but Canadians still use close to a billion cheques each year.Ī cheque is a written "order to pay", which you sign and give to another party as payment.

0 kommentar(er)

0 kommentar(er)